The Luka Koper Group’s performance in the first quarter of this year was mainly affected by weak economic activity in the euro area and slow growth in the global economy. The situation in the Middle East and the disruption of Red Sea shipping routes also had an impact on the business and on all stakeholders in the logistics chain in general. The conflict has led some shipowners to temporarily divert their ships to the route around Africa, causing significant delays in port arrivals and consequent delays in cargo handling.

“Despite the difficult situation, the company has managed to adapt to the new circumstances, maintaining all three direct container services from the Far East and taking advantage of new business opportunities in the meantime. At the same time, we have received assurances from key shipowners that Koper will continue to be an important entry point to Central Europe,” said Nevenka Kržan, President of the Management Board, summarising the performance in the first three months of 2024. She explained that the company had anticipated certain negative impacts on its business when preparing the business plan for 2024, but that despite this, most of the planned financial indicators were exceeded in the first three months of the year. In view of the above and the complexity of the situation, the first quarter of the year can therefore be assessed as a success.

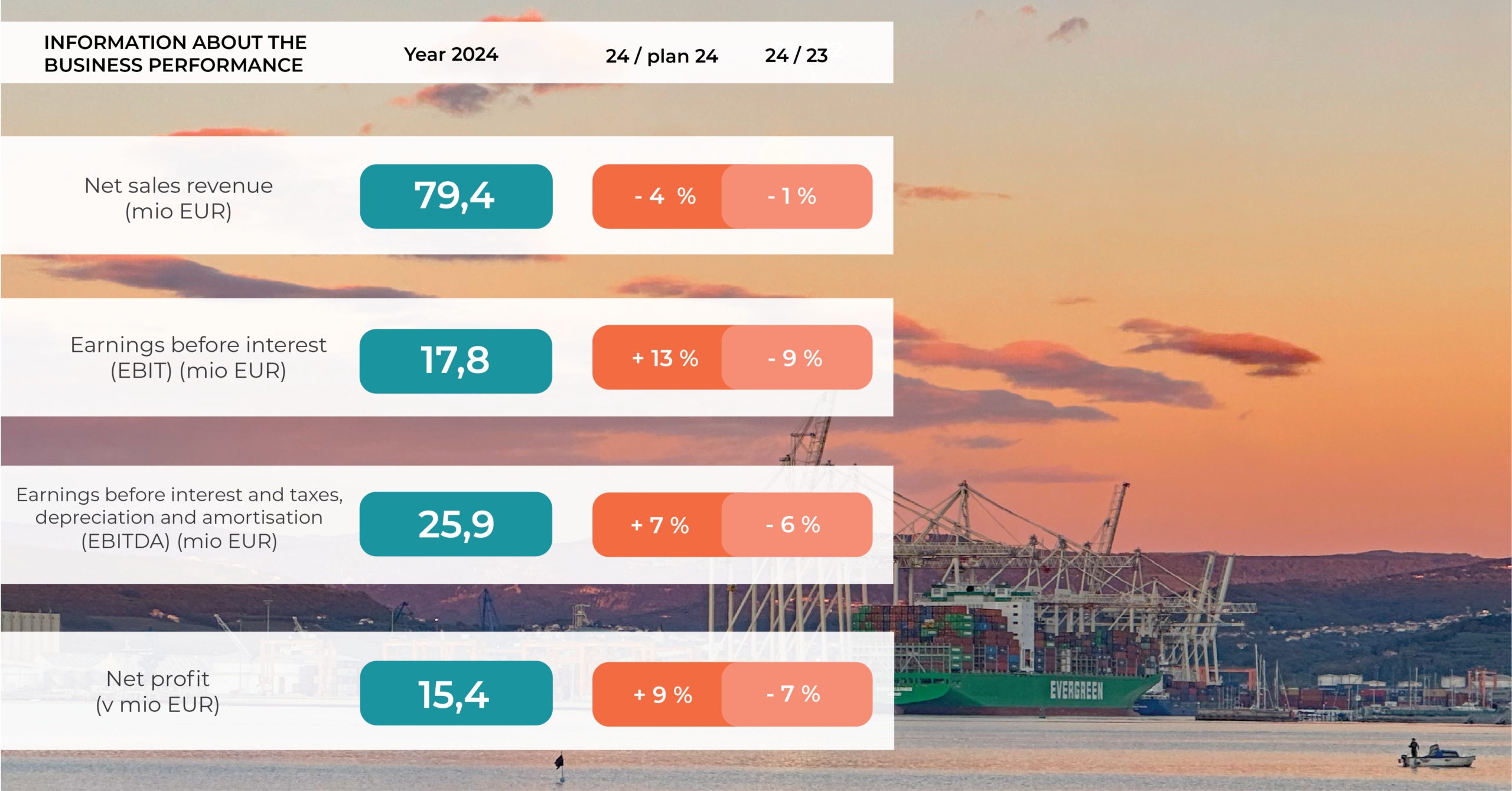

Net turnover was EUR 79.4 million, 4% below the planned level and 1% below the net turnover achieved in the first quarter of the previous year. In terms of the composition of revenues, revenues from increased container stuffing and stripping services and other additional services on goods were higher than in the previous year, while revenues from warehousing fees decreased due to the shorter dwell time of containers and other goods in storage.

The operating result (EBIT) amounted to EUR 17.8 million, EUR 2 million or 13% higher than planned. This was driven by 7% lower operating costs, mainly due to lower than planned headcount, lower volume-dependent service costs and lower energy costs. Compared to the same period of the previous year, the operating result (EBIT) was 9% lower, mainly due to a rise in labour costs, in addition to lower warehousing income. Net profit came to EUR 15.4 million, 9% above plan and 7% down on the prior-year period.

Slower-than-expected economic growth and the uncertain situation in the Middle East are expected to be reflected in slightly lower maritime throughput. At 5.3 million tonnes in the first quarter, it is 7% below the first quarter of 2023 and 9% below plan. Container throughput reached 256,240 TEUs, down 8% on the first quarter of last year, while car throughput reached 189,855 units, down 18%. Both commodity groups were affected by the challenging conditions described in the introduction and, in the case of cars, by the consequent weaker sales in certain markets. The throughput of the dry bulk commodity group was 18% lower compared to the same period in 2023, mainly due to lower coal throughput, while fertilisers, wheat and phosphates (bulk) were higher than in the same period last year. In the general cargo segment, growth was 10%, mainly due to higher throughput of steel products and equipment and higher timber exports, while liquid cargoes were also up by 3%.

In line with the annual and strategic business plan adopted at the end of last year, we continued our activities to increase port capacity, spending EUR 11.1 million, 38% more than in the first quarter of last year. We continued with the construction of Berth 12 at Pier 2 and the relocation of the storage blocks at the Container Terminal. We were also active in sustainable investments (4.5 million euros) as we installed a 3.3 MW photovoltaic power plant at the General Cargo warehouses, one of the largest in Slovenia.